Ed Catmull, a founding employee and the former president of Pixar, refers to early-stage ideas for films as “Ugly Babies.” The language is new, but the idea goes back centuries. In 1597, the philosopher Sir Francis Bacon wrote, “As the births of living creatures are at first ill-shapen, so are all innovations, which are the births of time.” Here is Catmull describing the need to maintain the balance between the “Ugly Babies,” or what I call “loonshots ”— fragile, unlikely ideas that are met with skepticism and often dismissed as crazy — and more reliable franchises — what he calls “the Beast” — in film:

Originality is fragile. And, in its first moments, it’s often far from pretty. This is why I call early mock-ups of our films “Ugly Babies.” They are not beautiful, miniature versions of the adults they will grow up to be. They are truly ugly: awkward and unformed, vulnerable and incomplete. They need nurturing — in the form of time and patience — in order to grow. What this means is that they have a hard time coexisting with the Beast.

When I talk about the Beast and the Baby, it can seem very black and white — that the Beast is all bad and the Baby is all good. The truth is, reality lies somewhere in between. The Beast is a glutton but also a valuable motivator. The Baby is so pure and unsullied, so full of potential, but it’s also needy and unpredictable and can keep you up at night. The key is for your Beast and your Babies to coexist peacefully, and that requires that you keep various forces in balance.

Keeping the forces in balance is so difficult because loon-shots and franchises follow such different paths. Surviving those journeys requires passionate, intensely committed people — with very different skills and values. Artists and soldiers.

You can analyze why an investment went south. But you will gain much more from analyzing the process by which you arrived at the decision to invest.

The many rejections of the first James Bond movie, Dr. No, for example, are typical for original films, just as the convoluted history of the first statin is typical for breakthrough drugs. Bond was too British for American studios; Fleming’s novels were “not even good enough for television.” Fleming gave up trying to sell the film rights to studios after a decade or so — nine novels into his series — and granted the rights to a pair of dubious producers. One had just bankrupted his production company. The other had limited film experience. The partnership did not start well. The first writers changed the villain of Dr. No to a high-IQ monkey, perched on a henchman’s shoulders. A later writer was so pessimistic about the final script (sans monkey) he insisted his name be removed. Half a dozen stars rejected the lead before the producers settled on a barely known 32-year-old named Sean Connery. Connery had driven milk trucks before acting. The distributor doubted they could sell the picture in major U.S. cities because there was “a Limey truck driver playing the lead,” so it opened the film at drive-in theaters in Oklahoma and Texas.

Developing the twenty-sixth Bond movie is an entirely different experience. Actors compete for roles in Bond #26; studios line up for marketing rights; cash pours in. We now understand that a British spy wearing Brioni can sell tickets. There can be bumps in the road (Timothy Dalton, the fourth Bond, happened) — but the directions are clear.

Bond needs a bad guy, a fast car, a smooth drink, a double-crossing damsel, and a few double entendres. Franchise projects are easier to understand than loonshots, easier to quantify, and easier to sell up the chain of command in large companies. The challenge for these sequels and follow-ons is not in making it through the long dark tunnel of skepticism and uncertainty. Their challenge is in exceeding what came before.

Bond, of course, survived those challenges just fine. The Bond films became the most successful film franchise in history.

Inventors or creatives championing loonshots are often tempted to ridicule franchises. But both sides need each other. Without the certainties of franchises, the high failure rates of loonshots would bankrupt companies and industries. Without fresh loonshots, franchise developers would shrivel and die. If we want more Junos and Slumdog Millionaires, we need the next Avengers and Transformers. If we want better drugs for cancer and Alzheimer’s, we need the next statin.

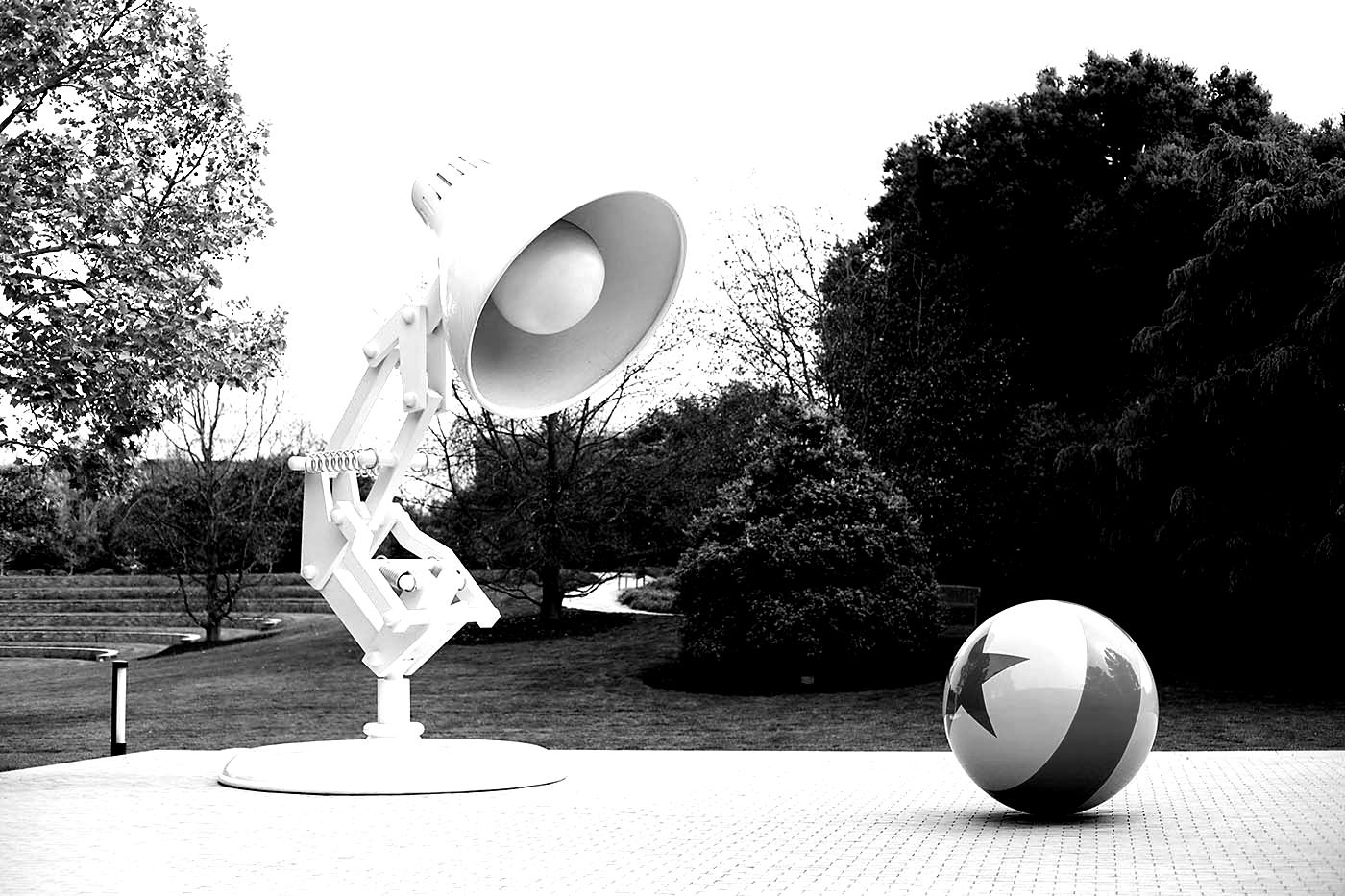

Pixar, as Catmull and others have described, created an environment well known for nurturing loon-shots while maintaining a balance between loon-shots and franchises. But perhaps the most interesting lesson that was readily visible at Pixar, was the difference between two ways of leading, which I’ll call “system mindset” and “outcome mindset.”

For the clearest explanation of this difference, let’s turn to a board game.

Garry Kasparov reigned as world chess champion for 15 years, the longest record in the history of the game. He ranks, on many lists, as the greatest chess player of all time. The difference between system and outcome mindset is a principle I adapted from his book How Life Imitates Chess. Kasparov describes this principle as key to his success.

We can think of analyzing why a move is bad — why pawn-takes-bishop, for example, lost the game — as level 1 strategy, or outcome mindset. After a bad move costs him a game, however, Kasparov analyzes not just why the move was bad, but how he should change the decision process behind the move. In other words, how he decided on that move, in that moment, in the context of that opponent, and what that means for how he should change his decision-making and game-preparation routine in the future.

Analyzing the decision process behind a move I’ll call level 2 strategy, or system mindset.

The principle applies broadly. You can analyze why an investment went south. The company’s balance sheet was too weak, for example. That’s outcome mindset. But you will gain much more from analyzing the process by which you arrived at the decision to invest. What’s on your diligence list? How do you go through that list? Did something distract you or cause you to overlook or ignore that item on the list? What should you change about what’s on your list or how you conduct your analyses or how you draw your conclusions — the process behind the decision to invest — to ensure that mistake won’t happen again? That’s system mindset.

You can analyze why you argued with your spouse. It was, let’s say, your comment about your spouse’s driving. But you may improve marital relations even more if you understand the process by which you decided it was a good idea to offer that comment. What state were you in and what were you thinking before you said it? Are there some different things you might do when you are in that state and think those thoughts? How good would it feel to sleep in your own bed?

Let’s apply the same principle to organizations. The weakest teams don’t analyze failures at all. They just keep going. That’s zero strategy.

Teams with an outcome mindset, level 1, analyze why a project or strategy failed. The storyline was too predictable. The product did not stand out enough from competitors’ products. The drug candidate’s data package was too weak. Those teams commit to working harder on storyline or unique product features or a better data package in the future.

Teams with a system mindset, level 2, probe the decision-making process behind a failure. How did we arrive at that decision? Should a different mix of people be involved, or involved in a different way? Should we change how we analyze opportunities before making similar decisions in the future? How do the incentives we have in place affect our decision-making? Should those be changed?

System mindset means carefully examining the quality of decisions, not just the quality of outcomes. A failed outcome, for example, does not necessarily mean the decision or decision process behind it was bad. There are good decisions with bad outcomes. Those are intelligent risks, well taken, that didn’t play out. For example, if a lottery is paying out at 100 to 1, but only three tickets are sold, one of which will win, then yes, purchasing one of those three tickets is a good decision. Even if you end up holding one of the two that did not win. Under those same conditions, you should always make that same decision.

Evaluating decisions and outcomes separately is equally important in the opposite case: bad decisions may occasionally result in good outcomes. You may have a flawed strategy, but your opponent made an unforced error, so you won anyway. You kicked the ball weakly toward the goalkeeper, but he slipped on some mud, and you scored. Which is why probing wins, critically, is as important, if not more so, as probing losses. Failing to analyze wins can reinforce a bad process or strategy. You may not be lucky next time. You don’t want to be the person who makes a poor investment, gets lucky because of a bubble, concludes he is an investment genius, bets his fortune, and then loses it all next time around.

At Pixar, Catmull probed both systems and processes, after both wins and stumbles. How should the feedback process, for example, be adjusted so a director is given the most valuable possible input, in a form most likely to be well received? Artists tend to hate feedback from suits or marketers or anyone outside their species, but they welcome it from thoughtful peers.

So at Pixar, every director receives private feedback on their project from an advisory group of other directors — and, in turn, serves on similar groups for other directors. And more: How might a director’s incentives distort their decision-making process on budgets, timelines, and quality? How should those distortions be countered? What filmmaking habits are in place, for outdated reasons, that might be unnecessary or counterproductive today?

What Catmull realized was that his job was minding the system rather than managing the projects.

It was also a message that got through to Steve Jobs, Catmull’s detail-obsessed boss for the early years of Pixar. Jobs had a role in the system — he was a brilliant dealmaker and financier. It was Jobs, for example, who insisted on timing the Pixar IPO with the Toy Story release, and Jobs who negotiated the Pixar deals with Disney. But he was asked to stay out of the early feedback loop on films. The gravity of his presence could crush the delicate candor needed to nurture early-stage, fragile projects. On those occasions he was invited to help near-finished films, Jobs would preface his remarks: “I’m not a filmmaker. You can ignore everything I say.”

Jobs had learned to mind the system, not manage the project.

(an excerpt from Loonshots by Safi Bahcall)

The Scriptures are full of imperatives, or commands, from God. Most of us feel like the Bible is nothing more than a rulebook. However, the Scriptures have more principles than it does commands. Principles are cause and effect. If you do this, this will happen. The Scriptures are loaded with cause and effect principles. One way to compare the difference is road signs. Let’s say that a speed limit sign on the road home says Speed Limit 55 MPH. That is a command. It is the law. Now I’m not going to dive into how we generally disobey that law…

On that same road you come to curve that is marked with those yellow signs with arrows indicating a sharp left curve. Preceding the curve signs is a sign that says Slow Down. Now, there is no law that you must slow down or curve left. But if you don’t slow down and curve left, you may no longer exist. The curve and Slow Down signs are great illustrations of principles.

Wisdom is a combination of two things: knowledge plus action. We have all seen the consequences of one without the other. The Scriptures warn us of being imbalanced in this regard. James challenges us to “not merely listen to the word, and so deceive yourselves. Do what it says.” In other words, knowledge without action is deceptive and foolish. On the other hand, the Wisdom writer tells us “it is not good to have zeal without knowledge, nor to be hasty and miss the way.” In other words, to act without knowledge is equally as foolish. Wisdom is the melting of these two together.

Scientists at NASA built a gun specifically to launch dead chickens at the windshields of airliners, military jets and the space shuttle, all traveling at maximum velocity. The idea was to simulate the frequent incidents of collisions with airborne fowl to test the strength of the windshields. British engineers heard about the gun and were eager to test it on the windshields of their new high-speed trains. Arrangements were made, and a gun was sent to the British engineers.

When the gun was fired, the engineers stood shocked as the chicken hurled out of the barrel, crashed into the shatterproof shield, smashed it to smithereens, blasted through the control console, snapped the engineer’s backrest in two and embedded itself in the back wall of the cabin…like an arrow shot from a bow.

The horrified Brits sent NASA the disastrous results of the experiment, along with the designs of the windshield and begged the US scientists for suggestions.

NASA responded with a one-line memo:

“Defrost the chicken.”

Integrity is the “frozen chicken” of becoming an influential student.

Don’t defrost.

______________

Journal your thoughts. We will discuss this later in the month in the Circle…